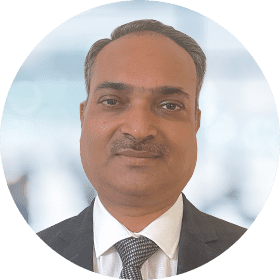

Gyanendra Tripathi

Partner & Leader (West)

Indirect Tax

Indirect Tax

Since the GST law is still evolving, there are areas which require clarifications from the authorities. We collaborate with clients to understand the specific issues and develop a probable solution, and work with the client to make appropriate representation (including drafting the representation) to various Government bodies, including the GST Council, which is the apex decision-making body for GST.

Dispute Resolution

We assist our clients in disputes and investigations by the tax authorities. We support them with:

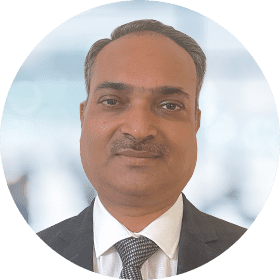

Gyanendra Tripathi

Connect with our professional team to discuss your needs using the form below